- +32 495 59 80 99

-

This email address is being protected from spambots. You need JavaScript enabled to view it.

Assets

Assets are permanently subject to risk. Risks have increased greatly over the past few years, whether due to globalisation, depletion of our planet's resources, unprecedented expansionary monetary policy on the part of central banks or geopolitical tensions.

A strategic approach

The only way to build up assets over the long term is to use a strategic approach. Asset accumulation and preservation and returns on investment are cornerstones for achieving financial freedom.

A strategic approach

The only way to build up assets over the long term is to use a strategic approach. Asset accumulation and preservation and returns on investment are cornerstones for achieving financial freedom.

Asset classes

Risk-free

No asset class is risk-free these days.

Even cash deposits at banks are exposed to the risk of the bank or the state becoming insolvent. Inflation causes cash to lose more than 40% of its value over a 20-year period.

Adopting a long-term perspective for the best returns

From a long-term perspective, investments in stocks show the best returns. For example, the average annual growth of the S&P Index (the US stock index) between 1985 and 2015 was 10.28%.

Example:

Let's assume you invested a sum of €50,000 in the S&P in 1985. By 2015, this would have increased to the massive sum of €941,613.

No asset class is risk-free these days.

Even cash deposits at banks are exposed to the risk of the bank or the state becoming insolvent. Inflation causes cash to lose more than 40% of its value over a 20-year period.

Adopting a long-term perspective for the best returns

From a long-term perspective, investments in stocks show the best returns. For example, the average annual growth of the S&P Index (the US stock index) between 1985 and 2015 was 10.28%.

Example:

Let's assume you invested a sum of €50,000 in the S&P in 1985. By 2015, this would have increased to the massive sum of €941,613.

Asset building

There are three key aspects to asset building:

1) Regular and long-term investing:

reduces the risk of investing at the wrong time and levels out asset purchase prices

2) Risk-spreading:

A broad geographic and sectoral spread reduces risks decisively

3) Performance:

The compound interest effect is a powerful wealth accumulation lever

1) Regular and long-term investing:

reduces the risk of investing at the wrong time and levels out asset purchase prices

2) Risk-spreading:

A broad geographic and sectoral spread reduces risks decisively

3) Performance:

The compound interest effect is a powerful wealth accumulation lever

Performance

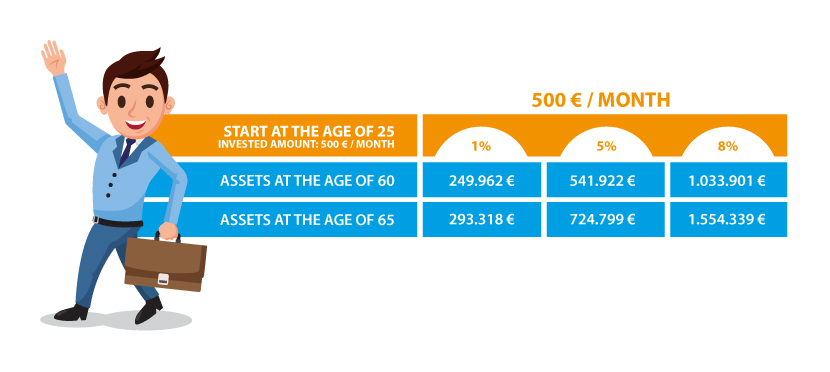

Example 1: Regular investing

The compound interest effect is a powerful wealth accumulation lever The average annual rate of return has a greater impact on wealth in retirement than the height of the monthly deposits.

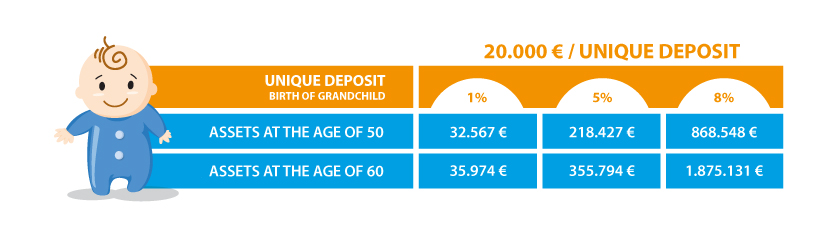

Example 2: One-time deposit for a grandchild

The compound interest effect is a powerful wealth accumulation lever The grandchild's wealth at the age of 60 will be decisively influenced by the return on investment, possible leading to an adequate additional pension in old age.

True wealth

Financial wealth is not true wealth.

True wealth is made up of emotions, peace of mind, joy, enjoying life, fulfilment, and living a self-determined life.

All that financial freedom can do is to help you achieve these goals.

Duarrefstrooss 31A, L-9944 Beiler

info@go4values.lu